How to Read Your CIBIL Report and Improve Your Credit Health

Understanding your CIBIL report is a crucial step in managing your financial health. Your credit score and CIBIL report play a significant role in determining your eligibility for loans and credit cards. This article will provide you with a comprehensive guide on how to read your CIBIL report and take steps to improve your credit health.

Table of Contents

What is a CIBIL Report

A CIBIL report, generated by the Credit Information Bureau (India) Limited (CIBIL), is a detailed record of your credit history, including your borrowing and repayment habits. It includes information on your credit accounts, payment history, and other personal details. This report is used by lenders to assess your creditworthiness before approving any new credit.

Components of a CIBIL Report

Understanding the various components of a CIBIL report can help you identify areas that need improvement. Here are the key elements:

- Personal Information:

– Your name, address, contact details, and date of birth.

– PAN card, passport number, and voter ID.

- Contact Information:

– Current and previous addresses and phone numbers.

- Employment Information:

– Current and past employers, and monthly or annual income.

- Account Information:

– Details of all credit cards, loans, and other credit accounts.

– Information such as credit limit, loan amount, current balance, and payment status.

- Enquiries:

– Records of whom and when someone requested your CIBIL report. Frequent enquiries can impact your credit score adversely.

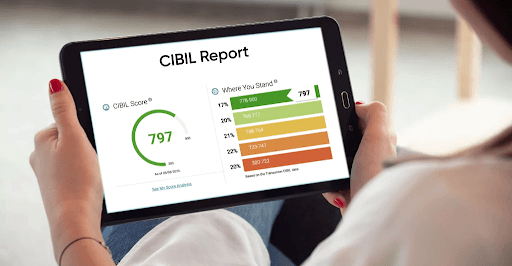

- Credit Score:

– A three-digit number ranging from 300 to 900, summarizing your creditworthiness. A higher score indicates better credit health.

How to Read Your CIBIL Report

After retrieving your CIBIL report either online or through your bank, here are steps to systematically read it:

- Verify Personal Information:

– Ensure all personal details such as name, date of birth, and contact details are accurate.

- Review Account Information:

– Check for any discrepancies or errors in your account details like incorrect balances, unrecognized accounts, or missing information.

- Check for Outstanding Balances:

– Identify any overdue amounts or accounts in default. Prioritize clearing these dues to improve your credit health.

- Analyze Your Payment History:

– Review the payment history for all accounts. Timely payments boost your credit score, while delays or defaults can harm it.

- Evaluate Enquiries:

– Excessive credit enquiries within a short period can lower your credit score. Be cautious about how often you apply for credit.

- Review Credit Score:

– Regularly monitor your credit score and make note of any significant changes.

Tips to Improve Your Credit Health

Improving your credit health is an ongoing process. Here are some strategies to help you enhance your credit score as reflected in your CIBIL report:

- Pay Your Bills on Time:

– Timely bill payments are one of the most significant factors affecting your credit score. Set reminders or automate payments where possible.

- Reduce Outstanding Debt:

– Try to pay off existing debt rather than moving it around. Reducing your credit card balances and loan amounts can improve your credit score.

- Avoid Multiple Credit Applications:

– Frequent credit applications can lower your score. Only apply for new credit when necessary and try to spread out applications over time.

- Maintain a Healthy Credit Mix:

– A balanced mix of secured (like home loans) and unsecured credit (like credit cards) is beneficial for your credit score.

- Monitor Your CIBIL Report Regularly:

– Regularly checking your CIBIL report helps you spot and rectify errors and stay updated on your credit health.

- Build a Long-Term Credit History:

– The longer your credit history, the better it reflects on your credit score. Keep old credit card accounts active, even if you don’t use them frequently.

- Limit Your Credit Utilization Ratio:

– Try to use less than 30% of your available credit limit. High utilization can negatively impact your score.

- Rectify Errors Promptly:

– Any discrepancies in your CIBIL report should be reported and corrected immediately. This includes unrecognized accounts, incorrect balances, or personal details.

Commercial CIBIL and Its Importance

Though individual credit health is crucial, businesses also need to maintain good credit to secure financial support. Commercial CIBIL reports provide insights into a company’s creditworthiness.

Components of a Commercial CIBIL Report

- Company Profile:

– Business name, registration number, address, and contact details.

- Credit Summary:

– Overview of the company’s credit accounts, repayment history, and outstanding balances.

- Credit Enquiries:

– Enquiries made by financial institutions about the company’s credit report.

- Credit Score:

– Similar to individual scores, commercial entities have a credit score reflecting their creditworthiness.

Improving Commercial Credit Health

- Timely Repayments of Business Loans:

– Ensure all business-related credit accounts are paid on time.

- Maintain Good Relationships with Vendors:

– Positive payment histories with vendors and suppliers contribute to good credit.

- Regularly Review Commercial CIBIL Reports:

– Periodic review helps in detecting inaccuracies and taking corrective measures.

- Manage Business Credit Utilization:

– Keep the credit utilization ratio low to maintain a healthy score.

- Separate Personal and Business Finances:

– Keep your personal and business finances separate to avoid confusion and ensure clear financial records.

Download Bajaj Finserv App for Easy Access to Your CIBIL Report

Download Bajaj Finserv App to manage finances and check your CIBIL report effortlessly. This user-friendly app offers quick access to your credit score, loan details, and financial tools. Stay updated on your creditworthiness and explore customized loan options within minutes. Simplify your financial journey with the Bajaj Finserv App today!

Conclusion

Monitoring and understanding your CIBIL report is essential for maintaining and improving your credit health. By regularly reviewing your report, paying your bills on time, reducing outstanding debts, and being cautious about new credit applications, you can enhance your creditworthiness. For businesses, maintaining a strong commercial CIBIL score is equally important to secure favorable financial opportunities.

Whether you are an individual or a business entity, a good credit score opens the door to better financial prospects, lower interest rates, and broader loan options. Taking proactive steps to improve your credit health will ensure you are well-positioned for future financial needs and opportunities. Remember, building a strong credit profile is a continuous process that requires diligence, discipline, and regular monitoring.